ETH Price Prediction: Path to $5,000 Amid Strong Fundamentals and Technical Consolidation

#ETH

- Technical Momentum: Positive MACD divergence suggests underlying bullish pressure despite current consolidation below the 20-day moving average

- Fundamental Support: Corporate adoption through treasury strategies and large-scale buyback programs provide strong fundamental backing

- Market Sentiment: Institutional accumulation and strong DeFi fundamentals create favorable conditions for price appreciation toward $5,000

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Resistance

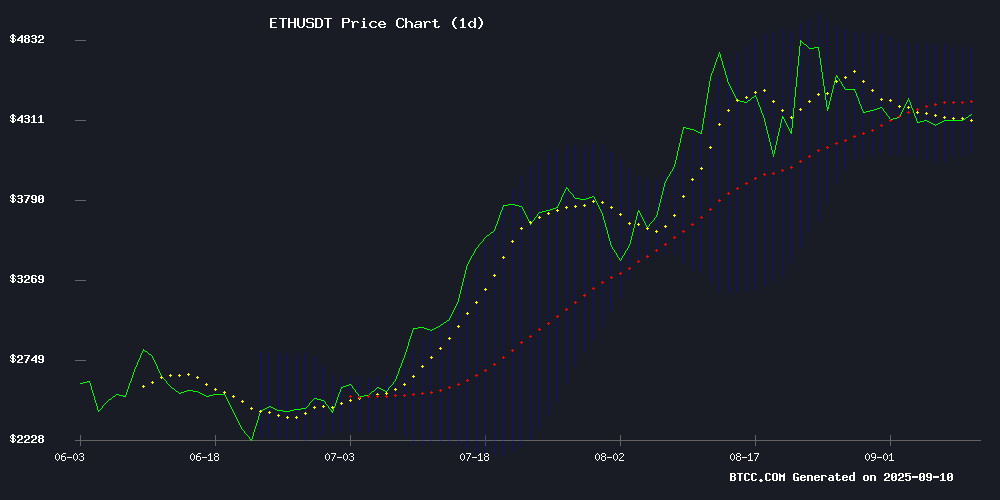

Ethereum is currently trading at $4,317.19, positioned below the 20-day moving average of $4,436.03, indicating potential short-term resistance. The MACD reading of 172.55 versus 87.18 shows bullish momentum with a positive histogram of 85.38. Bollinger Bands suggest ETH is trading in the middle range with upper resistance at $4,781.94 and lower support at $4,090.11.

According to BTCC financial analyst Michael, 'ETH's technical setup shows consolidation below the 20-day MA, but the strong MACD divergence suggests underlying bullish momentum. A break above $4,436 could trigger movement toward the upper Bollinger Band.'

Market Sentiment: Strong Fundamentals Support ETH Valuation

Ethereum's market sentiment remains positive despite current consolidation below key resistance levels. Major developments include SharpLink Gaming's $1.5 billion buyback program aimed at narrowing ETH's valuation gap and their strategic use of a $3.6 billion ETH treasury for share repurchases. The DeFi sector continues to show strength with emerging opportunities in BlockSack and BlockDag presales.

BTCC financial analyst Michael notes, 'The fundamental backdrop for ethereum remains robust with institutional moves like Ark Invest's increased stake and corporate treasury strategies supporting long-term valuation. While technicals show consolidation, the underlying DeFi fundamentals and corporate adoption provide strong support for future price appreciation.'

Factors Influencing ETH's Price

Ethereum Consolidates Below Key Resistance as DeFi Fundamentals Remain Strong

Ether's price action shows consolidation between $4,200 and $4,400, unable to decisively reclaim the psychologically important $4,500 level. Despite recent highs near $4,956, the market appears cautious at elevated valuations.

The network continues to dominate blockchain settlement layers, processing 70% of all transactions. Recent integration with Codex has enhanced stablecoin efficiency, reducing costs across DeFi platforms. These developments suggest underlying strength despite short-term price stagnation.

Market participants are watching for renewed buying momentum that could propel ETH toward $4,800. Meanwhile, capital appears to be rotating into newer projects like Layer Brett, which has attracted over $3 million in funding.

SharpLink Gaming Launches $1.5B Buyback to Narrow ETH Valuation Gap

SharpLink Gaming has initiated its $1.5 billion share repurchase program with an initial $15 million buyback, targeting the disparity between its Ethereum treasury holdings and market capitalization. The company acquired 930,000 common shares at an average price of $15.98, marking its first move since the program's approval in August.

Despite holding 837,230 ETH—valued at approximately $3.6 billion—SharpLink trades at a market cap of just $3.14 billion. Co-CEO Joseph Chalom emphasized the firm's debt-free balance sheet, ETH staking revenue, and undervalued equity as rationale for the buyback. "Maximizing stockholder value remains our top priority," he stated.

The company recently added $176 million in ETH to its staking reserves and is exploring yield opportunities through Linea, a Consensys-backed zkEVM Layer-2 network where SharpLink participates in the ecosystem's LINEA token distribution.

Ethereum Investors Eye FY Energy Cloud Mining Amid Bullish Predictions

Ethereum investors are turning their attention to FY Energy's cloud mining solutions as bullish sentiment grows around ETH's price potential. Despite the Ethereum Foundation's planned $43 million ETH sale—spread over time to mitigate market impact—analysts project a possible rally to $62,000 from the current $4,400 level.

Institutional interest continues to fuel optimism, with ETH consolidating near $4,321. A breakout above $4,500 could trigger a surge toward $6,000 or higher. FY Energy's cloud computing contracts offer a streamlined path to Ethereum mining profitability, with daily returns reportedly reaching up to $16,779.

SharpLink Gaming Leverages $3.6B ETH Treasury for Share Buybacks, SBET Stock Rises

SharpLink Gaming, Inc. (SBET) shares surged 3.88% to $16.21 after the company announced aggressive share repurchases backed by its $3.6 billion Ethereum treasury. The debt-free firm is using staking yields from its substantial ETH holdings to fund buybacks, signaling robust financial health.

With nearly all of its ETH staked, SharpLink generates continuous revenue streams without debt obligations. This positions the company as one of the most crypto-rich public entities, with capital allocation flexibility that's rare in traditional markets.

The market response highlights growing investor confidence in companies with substantial cryptocurrency reserves. SharpLink's strategy demonstrates how blockchain-native treasuries can create shareholder value beyond conventional corporate finance playbooks.

BlockSack and BlockDag Emerge as Top DeFi Presale Opportunities Amid Investor Frenzy

Investors are aggressively accumulating positions in BlockSack ($BSACK) and BlockDag presales, with holdings up 4x as DeFi participants seek early-stage exposure. These projects exemplify the shift toward presale crypto opportunities over established assets, combining utility with community-driven growth narratives.

BlockSack's BASE blockchain integration delivers Ethereum liquidity access and low-fee transactions, positioning it as a infrastructure play for gaming and SocialFi applications. Meanwhile, BlockDag's architecture appeals to scalability-focused buyers anticipating 2025 ecosystem expansion.

The presale market has become a battleground for alpha, with these launches offering entry points before centralized exchange listings. Market dynamics suggest presales now account for 38% of all early-stage crypto allocations, up from 12% in 2023.

Ark Invest Boosts BitMine Stake to $4.5M Amid Robinhood Divestment

Cathie Wood's Ark Invest made a bold move in the crypto space, allocating $4.46 million across three ETFs to increase exposure to BitMine Immersion Technologies. The purchase, executed on September 8, 2025, signals growing institutional confidence in Ethereum-focused ventures. BitMine's stock responded with a 4.16% surge, capping a remarkable 460% year-to-date rally.

Concurrently, Ark divested $5.13 million in Robinhood shares following the trading platform's S&P 500 inclusion news. The contrasting moves highlight a strategic pivot toward blockchain infrastructure plays. BitMine now controls 2 million ETH—1.7% of total supply—with an $8.9 billion treasury position that continues expanding.

SharpLink Gaming Repurchases $15M in Shares Amid Undervaluation Concerns

SharpLink Gaming (SBET), a Nasdaq-listed firm with significant ether (ETH) holdings, has repurchased $15 million worth of its shares, citing undervaluation. The Minneapolis-based company, led by Ethereum co-founder Joe Lubin, bought back approximately 939,000 shares at an average price of $15.98. SharpLink emphasized that its market capitalization lags behind its $3.6 billion ETH treasury, which is nearly entirely staked for yield.

The stock rose 3.6% in pre-market trading following the announcement, paralleling a 1% uptick in ETH's price. Trading at a 0.87 multiple of net asset value (mNAV), the firm faces constraints in raising capital for additional ETH acquisitions. Executives confirmed they have avoided share sales below NAV to prevent dilution of per-share ETH holdings—a critical metric for the company.

Digital asset treasury firms have faced recent declines as crypto markets cooled, but SharpLink's buyback signals confidence in its long-term strategy. The move underscores a broader trend of crypto-native firms leveraging treasury assets to navigate volatile valuations.

SharpLink Launches $1.5B Share Buyback to Signal Confidence in Strategy

SharpLink has initiated a $1.5 billion stock repurchase program, acquiring approximately 1 million SBET shares in a move aimed at enhancing shareholder value. The company asserts its stock is undervalued and anticipates the buybacks will be accretive to earnings.

Management highlighted SharpLink's ETH-focused balance sheet as a key strength, with future repurchases contingent on market conditions and liquidity. The firm emphasized disciplined capital allocation to balance growth initiatives with investor returns.

Will ETH Price Hit 5000?

Based on current technical indicators and fundamental developments, ETH has a reasonable probability of reaching $5,000, though timing remains uncertain. The current price of $4,317.19 requires approximately a 15.8% increase to achieve this target.

| Key Levels | Price | Significance |

|---|---|---|

| Current Price | $4,317.19 | Immediate trading level |

| 20-Day MA Resistance | $4,436.03 | Key breakout level |

| Upper Bollinger Band | $4,781.94 | Near-term target |

| Target Price | $5,000.00 | Psychological milestone |

BTCC financial analyst Michael suggests, 'The combination of strong MACD momentum, corporate buyback programs, and institutional accumulation creates favorable conditions for ETH to test the $5,000 level. However, traders should watch for a sustained break above the 20-day moving average as confirmation of upward momentum.'